(629) 288-1500

The Easiest Way To Comply

with the FTC Safeguards Rule

The Easiest Way To Comply with the FTC Safeguards Rule

We help simplify compliance with the FTC Safeguards Rule

for handling customer data for small businesses.

If You Handle Customer Sensitive Personal or Financial Info, This Rule Applies to You

Tax Professional? Mortgage Broker? Insurance Agency? HVAC Company? Auto Dealership?

If you collect sensitive personal or financial information from customers, the FTC Safeguards Rule applies to you. You're required to:

Appoint a Qualified Individual (QI)

Run periodic cybersecurity risk assessments

Encrypt and protect customer data

Train your staff

Maintain compliance documentation

Submit an annual report

Miss any of that - and you're exposed to fines of up to $51,744 per violation per day.

Who It's For

The FTC Safeguards Rule applies to businesses in these sectors:

Auto Dealerships

Insurance Agencies

Tax Professionals & CPAs

Real Estate & Property Management

Mortgage Brokers

Title & Escrow Companies

And others

Bottom line: If your business handles ANY sensitive personal data or personal financial data - whether you collect, store, or just transmit this type of data - you likely need to comply.

Why It Works For You

I've spent years helping mid-sized (and larger) companies:

Secure their infrastructure

Catch invisible threats

Maintain legal compliance

Understand what's going on

And sleep at night again.

Most Businesses Aren't Compliant.

And They Don't Even Know It.

The rule went into effect in June 2023. And enforcement is already underway.

The Problem?

Most businesses either don't know they're affected, or they assume their "IT guy handles it."

The Truth?

That's not how this works.

And that's where The FTC Fix comes in.

Statistics You Need to Know:

😨 43%

The percent of cyberattacks that target small businesses. They're "soft targets".

Source: Verizon DBIR 2023

🤯 60%+

60% of employees admit to reusing the same password across multiple systems.

Source: Varonis 2023 Data Risk Report

💰$4.45M

The average cost of a data breach is $4.45 million dollars.

Source: IBM Cost of a Data Breach Report

💀 71%

71% of small businesses have been victims of cybercrime. It's not a matter of "if", just "when"!

If these statistics don't make your stomach turn... they should!

How The FTC Fix Helps You Meet The FTC Safeguards Rule

Our FTC Fix program is designed to make compliance simple, affordable, and to assist your business in achieving full compliance with the FTC Safeguards Rule, helping you protect customer data and avoid fines.

What's Included in The FTC Fix?

Included

Visibility Scan

Why it Matters

Identify vulnerabilities in your systems that could expose customer data.

Dedicated Qualified Individual (QI)

We act as your DEDICATED designated QI to meet FTC requirements.

Compliance Documentation

Access to full, FTC-ready documentation and policies that are updated annually.

Staff Training

Required cybersecurity training, tracked and logged for audit purposes.

Vendor Reviews

Ensure third-party vendors comply with security standards.

Incident Response Plan

An Incident response plan to ensure you're prepared for potential issues.

We Communicate In Simple Language, Not Tech Jargon.

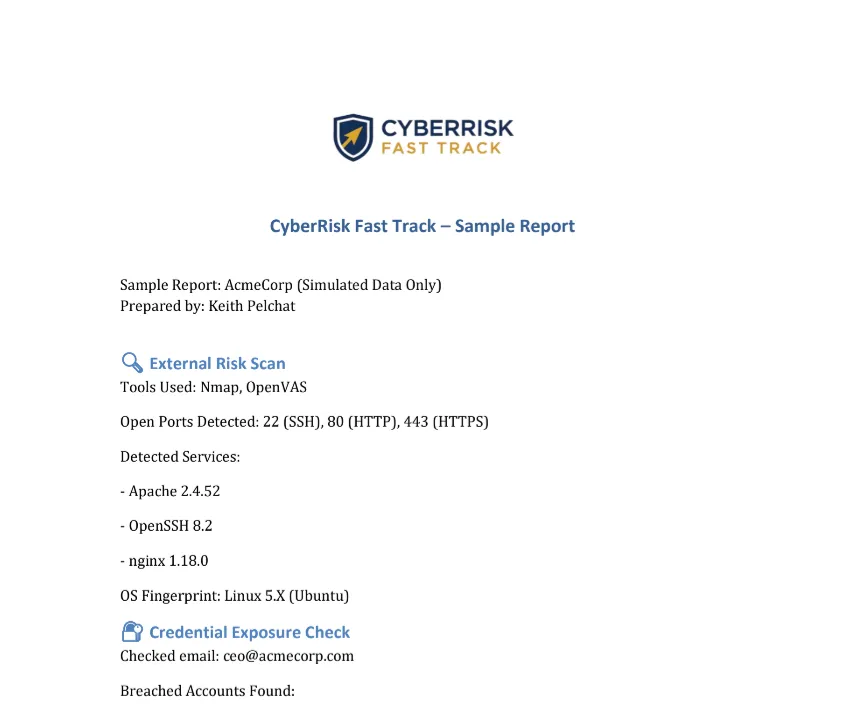

Curious what the Cybersecurity Compliance report looks?

We’ve created a sample version using publicly available data (no client info included) so you can see exactly how we present vulnerabilities, exposures, and action steps.

This is the level of clarity you'll get for your business — fast, clean, and fully customized.

Who You're Working With

Hi, I'm Keith Pelchat - and I've spent over 40 years helping businesses solve real problems with technology. I’m not here to scare you into buying “cyber insurance” or slap you with a bunch of buzzwords.

I’m here to give you real visibility into your risks, in plain English — so you can protect your business without hiring a full-time security team.

40+ Years of IT experience

15 years as a Microsoft Certified Trainer

7 years as a CompTIA Certified Instructor

Former Director of Business Intelligence for billion-dollar companies

Certified in Cybersecurity by CompTIA

When you book a scan with me, it’s not some black-box report from a faceless firm. You’re getting hands-on support from someone who’s been in the trenches — and knows how to make security make sense for small and mid-sized businesses.

Let me be your Dedicated Qualified Individual

in other words, your Fractional CISO

Choose Your Plan

Simple Scan

$495

$99 (limited time)

One Time

Compliance starts with visibility

Comprehensive scan to identify security vulnerabilities in how you handle customer financial data.

Comprehensive Risk Report.

Actionable Recommendations

No contracts - cancel anytime

Annual Compliance

$1495/Yr

No Contract / Setup

EVERYTHING IN Simple Scan

A DEDICATED Qualified Individual to meet the FTC's requirements.

Employee Training (Up To 10 Employees)

Annual Risk & Compliance Reviews

Annual Vendor Risk Assessment

Incident Response Plan

Annual Compliance Report

Email Support

No contracts - cancel anytime

quarterly compliance

$749/Qtr

No Contract / Setup

EVERYTHING IN Annual Compliance

A DEDICATED Qualified Individual to meet the FTC's requirements.

Multi-Location Support

Full Staff Training (Unlimited Employees)

Quarterly Risk & Compliance Monitoring

Advanced Vendor Risk Management

Dedicated Compliance Manager

Business Hours Phone Support

Priority Email Support

No contracts - cancel anytime

Plan Comparison

| Feature | Basic Scan | Annual Compliance | Quarterly Compliance |

|---|---|---|---|

| External Vulnerability Scan | |||

| Comprehensive Report | |||

| Actionable Recommendations | |||

| Annual Risk Assessment | |||

| Written Information Security Program (WISP) | |||

| Staff Training Modules | |||

| Compliance Documentation | |||

| Quarterly Updates | |||

| Dedicated Support | |||

| One-on-One Consultation |

📣 Real World Cyber Incidents

These are real, public examples that show what can happen when small businesses overlook cybersecurity. Use cases cited with attribution for educational purposes only.

"Our customer list was on the dark web."

A small government contractor found their client database being sold online after a phishing email tricked a senior employee.

Source: NIST Case Study

"We didn’t know the payment system was outdated."

A small restaurant bought a payment app on eBay that wasn't PCI compliant. The result? A data breach and credit card losses that temporarily shut them down.

Source: DeVries Case Study

"Ransomware froze our entire operation."

An SMB faced ransomware that locked critical data and demanded a payout. Downtime + data loss nearly put them out of business.

Source: UMaryland Cyber Law Case

"One email exposed everything."

An employee clicked a malicious link, giving hackers access to sensitive client data and damaging the firm’s reputation.

Source: LG Networks Case Studies

Why We Don't Publish Private Client Case Studies

We’ve chosen not to share detailed case studies of our private clients — because doing so could actually create a new security risk for them.

In our opinion, advertising their past vulnerabilities makes them a target. That’s not how we operate.

Instead, we’ve included publicly documented case examples above — and if you want to understand how this applies to your business, we're happy to walk you through a sample report.

The Cost of Doing Nothing

Remember: Fines can be as high as $51,744 Per Violation - PER DAY

Doing nothing is a decision.

It's just the most expensive one.

Your exact risk depends on your business’s practices and circumstances.

Your Compliance, Our Priority

We’re so confident that The FTC Fix will make your business fully

compliant with the FTC Safeguards Rule,

we offer a No-Questions-Asked Compliance Audit

after 30 days of use.

If you’re not seeing the improvements you expected,

we’ll personally review your compliance setup

and provide additional recommendations at no extra charge.

Your business stays secure, compliant, and ready for any audit.

No strings attached.

Not Ready To Commit?

Book Your FREE

15-Minute Risk Review

Just bring your questions.

I'll bring the data, the insights, and a step-by-step plan to protect your business.

Frequently Asked Questions

What is the FTC Safeguards Rule?

The FTC Safeguards Rule requires certain businesses to protect customer data through administrative, technical, and physical safeguards. It’s part of the Gramm-Leach-Bliley Act (GLBA).

Who is required to follow the FTC Safeguards Rule?

Any business classified as a "financial institution" under the FTC’s definition must comply — including auto dealers, tax professionals, lenders, and many solopreneurs who handle client financial data.

What counts as a financial institution under the FTC rule?

The FTC defines financial institutions broadly. If your business processes loans, issues credit, prepares taxes, or even stores sensitive customer financial info, it may qualify.

What happens if I don't comply with the FTC Safeguards Rule?

You may face legal investigations, business audits, civil penalties, and regulatory enforcement — even if you never have a breach. Fines can stack quickly.

How much can the FTC Fine me for non-compliance?

The FTC can issue civil penalties of up to $51,744 per violation. That means multiple fines for multiple violations.

What is a 'Qualified Individual' under the Safeguards Rule?

The Qualified Individual (QI) is the person responsible for implementing and monitoring your security program. Every covered business must assign one.

Does this apply to solopreneurs or coaches?

Yes. If you collect or store sensitive client information — especially credit card data or financial records — you may fall under the Safeguards Rule.

What's included in a compliance plan from The FTC Fix?

Each plan includes a gap assessment, documentation templates, employee training, vendor risk analysis, and access to a Qualified Individual.

How long does it take to get compliant?

Most small businesses can complete the foundational steps in under 30 days using our guided FTC Fix roadmap.

How is The FTC Fix different from my IT company or MSP?

Most IT companies focus on tools. We focus on your regulatory responsibilities — training your team, documenting your plan, and managing compliance directly.

© 2026 The FTC Fix | Terms & Conditions | Privacy Policy | Data Use & Confidentiality | Refund Policy

[email protected] | (629) 288-1500

FTC Disclaimer: The FTC Safeguards Rule is a minimum standard for security. Compliance with the FTC Safeguards Rule does not guarantee the prevention of a breach or the avoidance of fines. Businesses must continue to take reasonable steps to protect sensitive data.

We take your privacy and security seriously. All data submitted through this site is encrypted and stored securely via our CRM platform. This website is powered by GoHighLevel, which uses industry-standard security protocols to protect your information. Read our Privacy Policy for full details.

Examples cited are educational, publicly sourced incidents — not client case studies.